Additional Duties, Tariffs, and Tax |

Tradeflow helps in determining duties and tax exemptions for categorized products. Use these sections to key in the required information on Additional Duties, Tariff Concessions, Tax Codes. These sections are enabled depending on the Classification Country/Union selected. If you would like a copy of the rules for a specific Classification Country/Union contact Tradeflow Support.

|

To access Additional Duties, Tariff Concessions, and Tax Codes Sections |

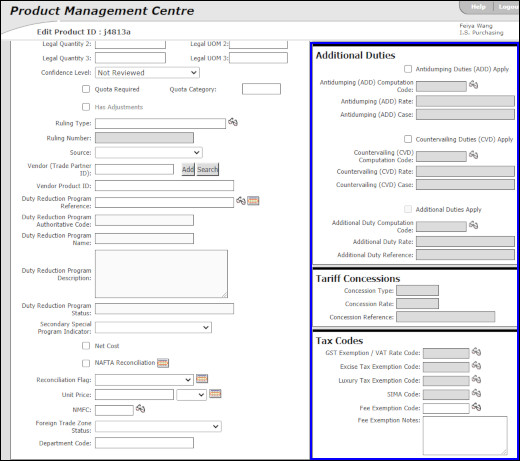

Figure 1: Additional Duties, Tariff Concessions, and Tax Codes Sections

To access Additional Duties, Tariff Concessions, and Tax Codes Sections:

1 Click Add Products from the left navigation panel or click Find Product and search for the product you want to modify.

2 The Additional Duties, Tariff Concessions, and Tax Codes sections are located near the bottom of the page.

3 For the Additional Duties section, select the check boxes to enable the fields.

4 The Tariff Concessions and Tax Codes sections are enabled depending on the Classification Country/Union profile.

A list of the fields that appear in the Additional Duties section:

Field |

Description |

|---|---|

Antidumping Duties (ADD) Apply |

Select this check box to enable the fields for the Antidumping Duties section. |

ADD Computation Code |

Click

|

ADD Rate |

Enter the ADD rate in percentage (%). |

ADD Case |

Enter the ADD case. |

Countervailing Duties (CVD) Apply |

Select this check box to enable the fields for the Countervailing Duties section. |

CVD Computation Code |

Click

|

CVD Rate |

Enter the CVD rate in percentage (%). |

CVD Case |

Enter the CVD case. |

Additional Duties Apply |

Select this check box to enable the fields for the Additional Duties section. |

Additional Duty Computation Code |

Click

|

Additional Duty Rate |

Enter the Additional Duty rate in percentage (%). |

Additional Duty Reference |

Enter the Additional Duty Reference. |

Tariff concessions allow companies to obtain reduced or eliminated duties and taxes.

A list of the fields that appear in the Tariff Concessions section:

Field |

Description |

|---|---|

Concession Type |

Enter the concession type. |

Concession Rate |

Enter the concession rate in percentage (%). |

Concession Reference |

Enter the concession reference. |

A list of the fields that appear in the Tax Codes section:

Field |

Description |

|---|---|

GST Exemption / VAT Rate Code |

Click

|

Excise Tax Exemption Code |

Click

|

Luxury Tax Exemption Code |

Click

|

SIMA Code |

Click

|

Fee Exemption Code |

Click

Note: This is only applicable for products with US as the Classification Country.

Code options: 1: Cotton Fee 2: Other Agriculture Fee 3: Other Fee Exemption |

Fee Exemption Notes |

This

field is required if you selected Other

Fee Exemption for the Fee

Exemption Code field. This field is optional for Cotton Fee and Other Agriculture Fee. |

© 2021 Property of Expeditors International of Washington, Inc. and its subsidiaries.

Business Confidential and Proprietary. Reproduction by written authorization only.

- Created by: Expeditors Technical Communications Department -