Manage Product Information |

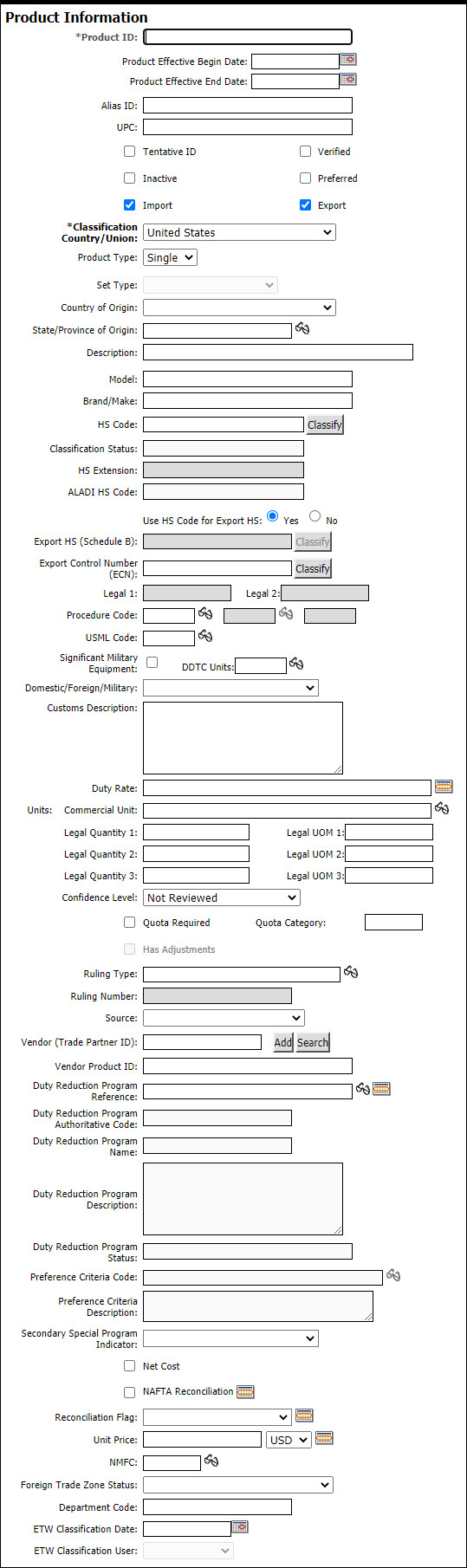

The Product Information section in the product detail page is designed to help you enter the product compliance and regulatory related information such as the Product ID, HS code, Country of Origin, etc.

|

Note: If you are associating a product to a trade partner, be sure to have that trade partner uploaded or created in your Trade Partner Centre. See the Trade Partner Centre Help for more information on how to create trade partners. |

![]() Click

to watch a video about classifying products.

Click

to watch a video about classifying products.

To manage product information:

1 Click Add Product from the left navigation panel or click Find Product and search for the product you want to modify.

2 The Product Information section is at the top of the page. See the field definitions below for help on filling out the Product Information section.

|

Note: Based on the Classification Country/Union selected, some of the rules and controls may be disabled. |

Figure 1: Product Information Section

A list of the fields that appear in the Product Information section:

Field |

Description |

|---|---|

| *Product ID | User-defined Product Identification number. This is a required field. |

| Product Effective Begin Date | Start of the period

during which the product is effective and can be transacted.

Click |

| Product Effective End Date | End of the period during

which the product is effective and can be transacted.

Click |

| Alias ID | User-defined alias ID of the product. |

UPC |

Universal Product Code of the product. |

| Tentative ID | Select this check box if the Product ID is tentative and may be finalized in the future. |

| Verified | Select this check box if the product's HS code is verified. |

| Inactive | Select this check box to inactivate the product information temporarily. When a product is inactive, the product does not appear in the List-view of any search. |

| Preferred | Select this check box if the product ID is preferred. For example, if you have similar products and want to prioritize them, you would select this check box for the product with highest priority. |

| Import | Select this check box to indicate if the product is an import. |

| Export | Select this check box to indicate if the product is an export. |

| *Classification Country/Union | Country that classifies the product. This is used in determining the HS code. Some fields in the Product Information section are country-specific and will be enabled depending on the country/union entered here. |

| Product Type | Product Type. Options are:

|

Set Type |

If the Product Type is Set you can choose the type from the drop-down list.

Products with the Classification Country of United States will have multiple options for customs sets, whereas non-U.S. countries will have only the option of “Customer Defined”. |

| Country of Origin | Country the product is sourced from. |

| State/Province of Origin | State/Province where

the product was originally produced. Click |

| Model | Enter the Model Name/Number. |

| Brand/Make | Enter the Brand Name. |

| HS Code | Harmonized Schedule

code of the product. You can enter the HS code or click

Classify

to classify the product and determine the HS code.

See Duty Reduction Program for more information. Note: If your product is a Set and belongs to the Classification Country/Union - United States you will use the Complex HS Classification Wizard. Otherwise, the regular HS Classification wizard will be used to determine the HS code. |

Classification Status |

Automatically determines if the HS Code entered is valid, invalid, or unknown. |

| HS Extension | Enter the HS Extension number |

| ALADI HS Code | ALADI HS Code of the

product. You can enter the ALADI HS code or click Classify

to classify the product and determine the ALADI HS code.

This field is specific to Latin American countries and supports the intra-Latin American trade program ALADI. |

Use HS Code for Export HS |

Choose the Yes radio button if you want to use the HS code for the Export HS as well. |

Export HS (Schedule B) |

The Export HS field is enabled if Export is checked, and if Use HS Code for Export HS is set to No.

The Export HS is available to any Classification Country/Union to load a value.

However, the Classify button is only enabled for United States, because it is the only country where separate export classification (Schedule B) content is available. |

| Export Control Number (ECN) | Export Control Number of the product. You can enter the Export Control Number or click Classify to classify the product and determine the Export Control Number. This field is enabled if Export is checked. |

Legal 1 / Legal 2 |

Enter the units of measure (UOM) for export. |

| Procedure Codes | The Procedure Codes

are used to identify the Customs Procedures that apply

to the product. Click |

| USML Code | Two digit US Munitions

List code. This field is enabled if the Classification

Country/Union - United States and the Export check box

is selected. Click |

| Significant Military Equipment | If the product is considered Significant Military Equipment, select this check box. This check box is enabled if the Classification Country/Union - United States and the Export check box is selected. |

DDTC Units |

Enter

the Directorate of Defense Trade Controls units of measure

(UOM) code. Click |

| Domestic/Foreign/Military | Select the expected product use. This check box is enabled if the Classification Country/Union - United States and the Export check box is selected. |

| Duty Rate | Rate at which duty will

be applicable for the product. Will be automatically populated

for all the valid HS codes, if it is classified. Click

|

| Units | Commercial and legal units of measure. |

| Confidence Level | Your confidence level

of the HS code. Reflects the accuracy of the HS code.

Various confidence levels are:

|

| Quota Required | Select this check box if the product is regulated by a Quota. |

| Quota Category | Specify the quota category. |

Has Adjustments |

Select this check box if the price of the product being imported needs to be increased or decreased based on certain factors. Click Manage to add an adjustment. See Adjustments for more information. |

| Ruling Type | Use the Look-up icon

|

| Ruling Number | Classification Ruling Number assigned by Customs. This field is enabled only when a ruling type has been selected. |

| Source | Source of Verification of the HS code. Select from the drop-down list. |

Vendor Product ID |

The vendor's Product Identification number. |

| Duty Reduction Program Reference | This is not enabled

for all classification countries. If applicable,

click See Duty Reduction Program for more information. |

Duty Reduction Program Authoritative Code |

The official code that represents the program, which provides a confirmation whether the user-entered DRP Reference value is authoritative. See Duty Reduction Program for more information. |

Duty Reduction Program Name |

A name, often an abbreviation, given by the trade content for the DRP. See Duty Reduction Program for more information. |

Duty Reduction Program Description |

Usually a longer, more descriptive name of the program, as given by the trade content. See Duty Reduction Program for more information. |

Duty Reduction Program Status |

A value that represents a cross-checking of the DRP Reference against the HS code entered, the Classification Country of the product and the Country of Origin (if present). See Duty Reduction Program for more information. |

| Secondary Special Program Indicator | If there is a secondary special program, choose it from the drop-down list. |

Preference Criteria Code |

Enter

the preference criteria code. Use the Look up icon See Preference Criteria for more information. |

Preference Criteria Description |

The preference criteria description will automatically populate when a valid preference criteria code is entered. If an invalid preference criteria code is added, UNKNOWN will be shown. See Preference Criteria for more information. |

| Net Cost | Select this check box to indicate Net Cost. |

| NAFTA Reconciliation | Select this check box

if the duty reduction program is NAFTA. Click |

| Reconciliation Flag | Select appropriate reconciliation

flag from the drop-down list if you expect to get a waiver

on the duties. Click |

| Unit Price | State the Unit Price.

Select

the currency for the Unit Price from the drop-down list.

Click |

| NMFC | Enter NMFC (National Motor Freight Calculation) Code. |

Foreign Trade Zone Status |

Status for foreign trade zones. |

| Department Code | The code for the department that handles your product. |

ETW Classification Date |

This

is for Tradewin Consultant use only. Enter the classified

date. Click |

ETW Classification User |

This is for Tradewin Consultant use only. Click the drop-down list to select the consultant. |

Special Handling Requirements |

Enter any special handling instructions. |

© 2021 Property of Expeditors International of Washington, Inc. and its subsidiaries.

Business Confidential and Proprietary. Reproduction by written authorization only.

- Created by: Expeditors Technical Communications Department -